Livestock outlook steadier, but rising debt signals financial stress across agriculture

WASHINGTON: U.S. farmer sentiment continued its downward slide in August, with the Purdue University-CME Group Ag Economy Barometer falling 10 points to 125. The index reflected weaker optimism about the future as declining crop profit margins weighed heavily on producers, despite relative stability in livestock markets.

The Index of Future Expectations dropped 16 points to 123 — the lowest since September last year — while the Current Conditions Index inched up slightly to 129. The August survey was conducted from August 11–15, 2025.

Crop vs. livestock outlook

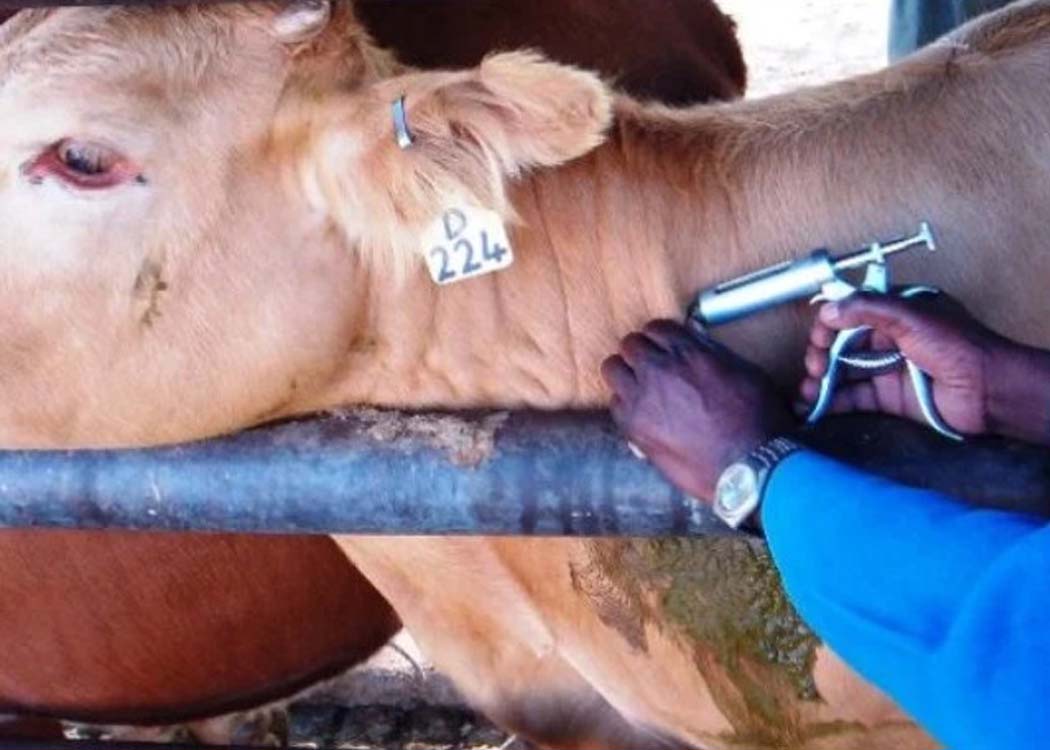

Sentiment varied sharply by sector. Crop producers reported far less optimism compared to livestock farmers, citing below-cost crop prices as the key driver of pessimism. By contrast, beef cattle operations are enjoying record profitability, supported by the smallest cattle inventory since 1951 and record-high cattle prices.

The disparity highlights a structural divide: while livestock markets remain buoyant, crop farmers are bracing for further income pressure.

Financial strain intensifies

The Farm Financial Performance Index remained subdued at 91, reflecting ongoing income concerns. USDA projections for the 2025–26 marketing year forecast average corn prices at $3.90 per bushel and soybeans at $10.10 per bushel, both below estimated break-even levels for U.S. farms.

Despite this weak outlook, the Farm Capital Investment Index rose 8 points to 61, partly driven by livestock producers’ more positive expectations.

Farmland and rental values

The Short-Term Farmland Value Expectations Index dipped to 112, extending a three-month decline. Still, more farmers expect land values to rise than fall. Around three-fourths of crop producers also anticipate farmland cash rental rates in 2026 to remain steady compared to 2025, with only 12% expecting a decline.

Rising debt concerns

Financial stress appears to be growing. In August, 22% of farmers said their 2026 operating loans would be larger than in 2025, up from 18% in January. Among them, nearly a quarter admitted the increase was due to carrying over unpaid debt — a sharp rise from January 2023, when only 5% reported this reason.

This trend underscores worsening financial strain in production agriculture, with more farms relying on larger loans to cover operating shortfalls.

Expert insight

“In sum, the August Ag Economy Barometer survey results show that U.S. farmers generally expect their financial performance for the coming year to drop from the previous year,” said Michael Langemeier, barometer principal investigator and director of Purdue’s Center for Commercial Agriculture. He added that rising debt rollover is a concerning signal of mounting financial stress.